Business loan application form

Comprehensive business loan application template to generate leads. Collect personal information, loan details, business plan, collateral information, and other essential information from applicants.

- Secure

- GDPR-compliant

- Mobile-friendly

- WCAG2-compliant

- Blazing fast

- Customizable

Multi-step layout

Using a multi-step layout is essential for application forms. It breaks down the application into manageable chunks, making it easier for the applicant to fill out the form. This template has the following steps, each covering a category of questions:

- Welcome page: Company logo, name, and a quick intro explaining the application form.

- Personal Info: Collect applicant's personal information, including address.

- Business Info: Get information about the business - like official name, entity type, incorporation documents, start date, etc ...

- Loan request details: Get details about the loan request, like amount, purpose, and loan term.

- Business plan: Inquire about the business plan, and allow uploading of documents like a business plan and future projections.

- Collateral: Collect information about the collateral, like type of collateral, value, lien, and any supporting ownership documents.

- Confirm: Show an overview of the entered information, allowing users to go back and edit.

- Disclaimer: Custom text and disclaimers, which can point to external link(s), like terms and conditions, data retention policy, etc ...

Variations

You can add or remove the fields in this template to create different variations based on your needs, such as:

- Equipment Finance:

For businesses looking to finance equipment purchases, collecting details on the equipment and financial health of the company.

- Line of Credit:

Allows businesses to apply for a revolving line of credit, requiring similar financial and business information.

- Invoice Financing:

Enables businesses to secure advances on outstanding invoices, collecting customer details and invoice specifics.

- Cash Advance:

Application for businesses seeking cash advances based on future sales.

Multilingual forms

Formcrafts has built-in support for multilingual forms. You can add languages to your form and show the correct language to your users based on their preference. You have full control over the translated text.

This form includes translations for 🇪🇸 Spanish and 🇫🇷 French

Auto-save application progress

Application forms can take a while to fill, since the users have to gather all the information and documents. To help your applicants you can enable the auto-save feature. This will periodically save the form progress, allowing applicants to return to the form anytime (on the same device).

Upload loan documents

The template contains various file uploads fields. They allow the applicant to upload loan documents such as incorporation certificate, business plan, and more. The file upload field can be configured to only allow certain types of files, such as pdf.

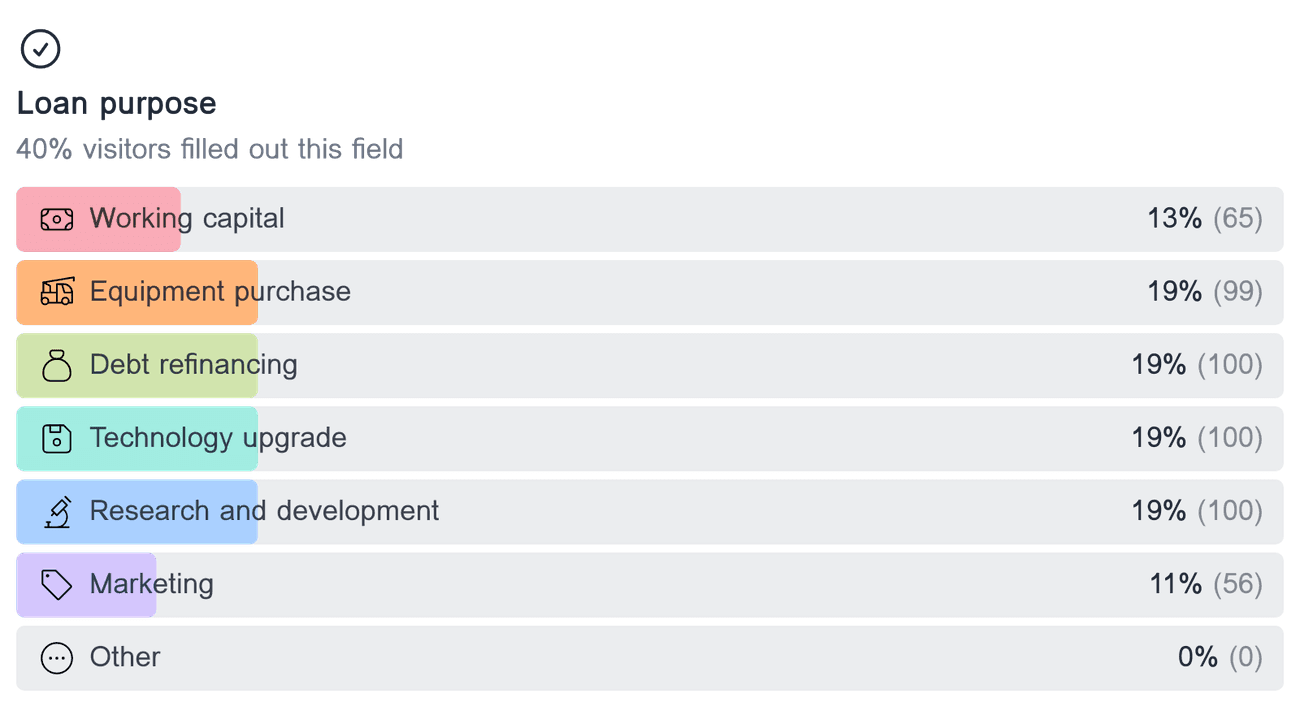

Detailed insights on loan purpose

Field analytics can offer insights into form responses. Example, an analysis of the Loan purpose field will show the lenders the most common reasons for loan applications. This can help tailor loan products, improve customer satisfaction, and target marketing more efficiently by looking at the demand trends.

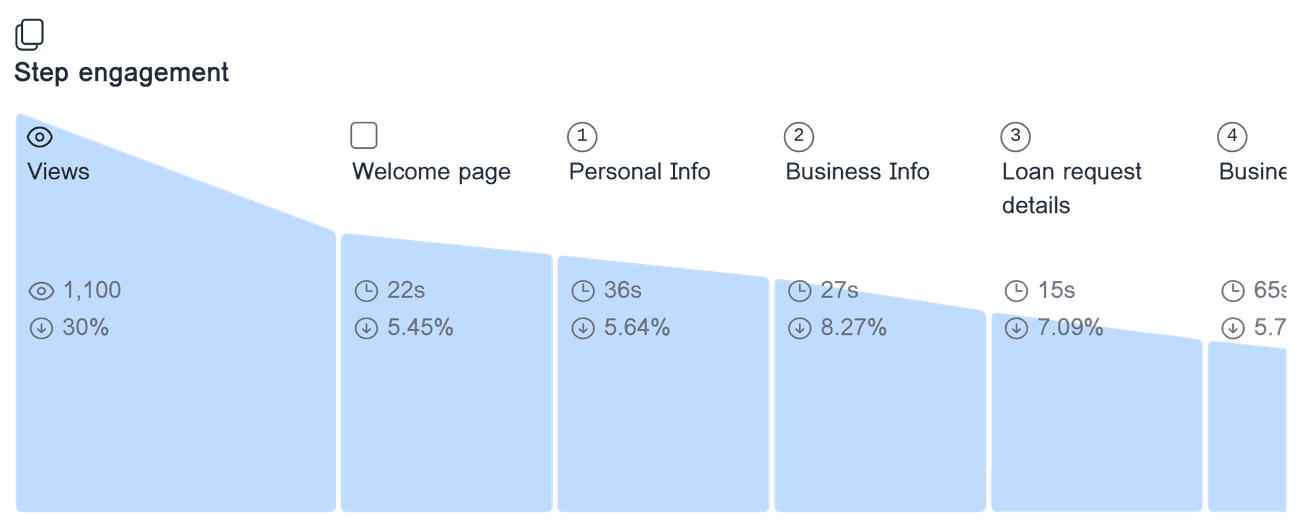

Engagement and drop-off analysis

Engagement analysis helps you understand how applicants interact with your loan application form. By seeing which steps take the most time and where users drop off, you can identify bottlenecks and improve the form. This can help in improving the conversion rates, generating more leads.

Questions and answers

Is the template responsive?

Yes, the template is responsive, which means it will work well on both desktop and mobile devices. Anyone who needs to fill out the form can do so easily, no matter what device they are using.

How can I share the form with applicants?

Once you’ve customized the form, you can share it by providing a direct link to the form webpage. You can also embed the form on your website or share it via email and social media platforms to reach your audience.

How do applicants know they have successfully submitted their application?

After applicants fill out the form and confirm their information, they will receive a confirmation email. You can customize this email to provide any extra information or next steps, ensuring applicants know their submission was successful.

Related templates

- Secure

- GDPR-compliant

- Mobile-friendly

- WCAG2-compliant

- Blazing fast

- Customizable